The Asset Finance Specialists

Since 1981, Moody Kiddell has partnered with Australian businesses, providing finance and insurance solutions, saving you valuable time so you can focus on what you do best, running your business.

We take the time to understand your business, and with over forty years of multi-industry experience, we can tailor loans to suit your business’ individual needs.

More Lending Solutions

Our relationships with a range of lending partners, from traditional banks to non-bank lenders, give us access to financing solutions for all borrowers.

Long-term Partnerships

We pride ourselves on building long-term partnerships with our clients. Your success is our business, and in every step of our relationship we invest our core values of Integrity, Service & Performance.

Expert knowledge. Immovable support. That’s what it means to be Partners With You.

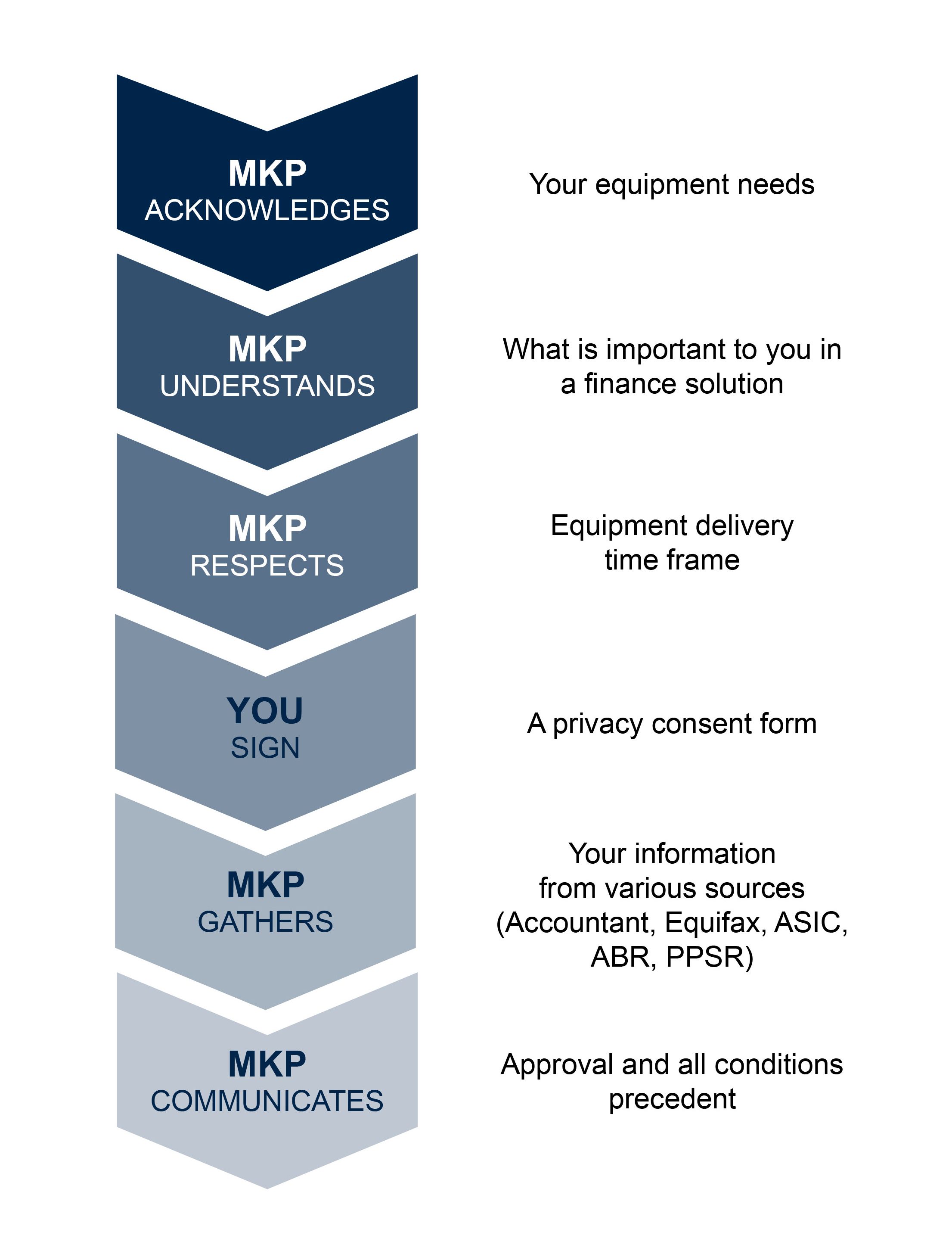

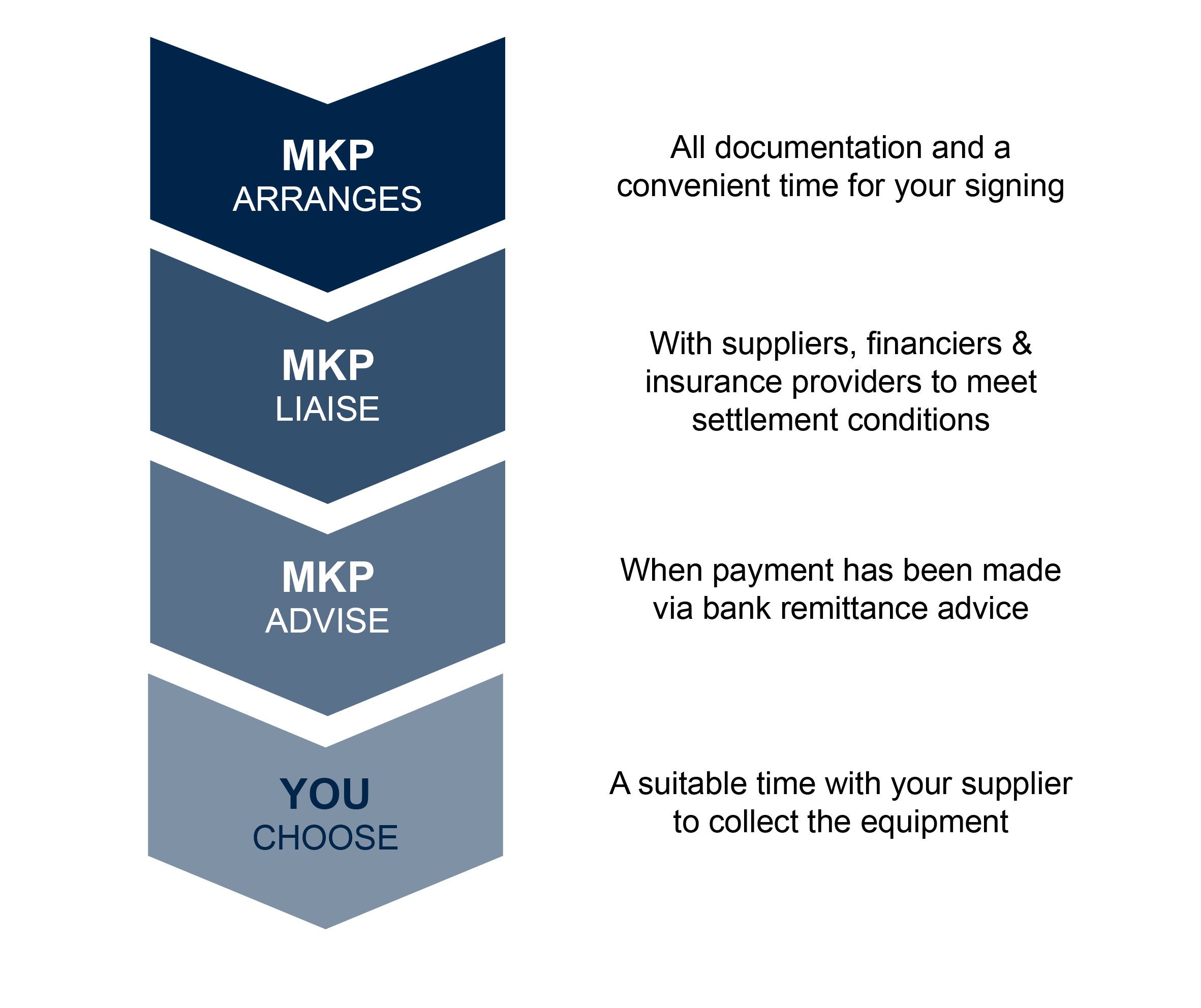

Your enquiry will be handled by our specialist MKP Premium team and will include:

- Electronic Privacy Form for ease of signing;

- In person meetings to help MKP gain a deeper understanding of your business;

- Proactive updates via telephone call, email & SMS throughout the finance process;

- In person document signing which allows MKP to explain the finance agreement in detail and offers you an opportunity to ask questions;

- Capital Expenditure meeting to understand your growth ambitions and potential equipment finance requirements.

- Ongoing communication throughout the finance term;

- Proactive feedback opportunities

Our fee is not charged directly to you. Our panel of lenders pay MKP a fee for sourcing, introducing, collecting and collating, preparing, negotiating, communicating and processing finance transactions on your behalf from start to finish.

A fee is not received until a transaction finalises (unless otherwise negotiated with clients).

Some reasons to call MKP during your loan term include (but are not limited to):

- Payout Request

- Direct Debit changes

- Refinance Requests

- Hardship Requests