Game Changing Update to the Instant Tax Write-Off

The Treasurer announced a significant change to the Instant Tax Write-Off.

Businesses will now be able to write-off the full value of any eligible asset purchased for their business.

The scheme will be available for small, medium and larger businesses with a turnover of up to $5 billion, until 30 June 2022.

Instant Tax Write-Off Applies to Second-Hand Equipment

Businesses with a turnover under $50 million can claim an immediate tax deduction for second-hand assets purchased and installed between today and 30 June 2022.

Business with a turnover of $50 million to $500 million can claim that same deduction for second-hand assets costing up to $150,000 if they are purchased by 31 December 2020 and installed ready for use by 30 June 2021.

Tax Relief for Business

Special measures have also been announced for Australian businesses who went from being profitable to loss-making due to the impact of COVID-19.

Companies with a turnover of up to $5 billion will be able to offset losses against previous profits on which tax has been paid to generate a refund.

Losses incurred to June 2022 can be offset against prior profits made in or after the 2018‑19 financial year.

Infrastructure Investment

Measures in this Budget, together with what has been announced since the start of the COVID-19 crisis will see $14 billion in new and accelerated infrastructure projects to support a further 40,000 jobs.

The infrastructure investment will fund major projects across each state.

JobMaker Hiring Credit

The Government announced a hiring credit called JobMaker to encourage businesses to hire younger Australians.

The JobMaker hiring credit will be payable for up to twelve months and immediately available to employers who hire those on JobSeeker aged between 16-35 years.

It will be paid at the rate of $200 per week for those aged under 30, and $100 per week for those aged between 30-35 years.

New hires must work for at least 20 hours a week.

Excluding banks, all businesses are eligible.

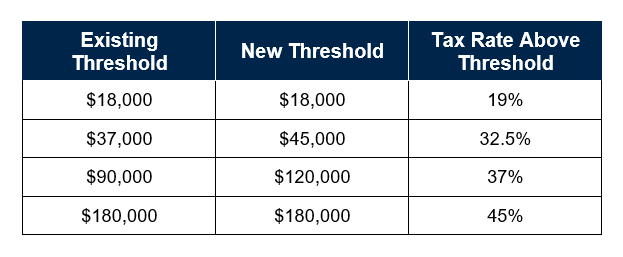

Personal Income Tax Cuts

The personal income tax cuts will put more money in your employees back pocket at no additional cost to you.

Source ATO and Westpac Economics

Source ATO and Westpac EconomicsIf you have delayed purchasing equipment now is the time to take full advantage of the Government’s supercharged Instant Tax Write Off incentive.

Contact Moody Kiddell on 1300 000 657 or complete our form if you would like pre-approved finance for your next purchase.

Please speak to your accountant and tax agent for specific advice regarding these these updated Government initiatives.